Nuestras soluciones cubren 8 campos de acción para ayudarlo en todas las etapas de sus proyectos. IGE+XAO cubre todas las necesidades, desde esquemas eléctricos simples hasta instalaciones eléctricas complejas y PLM (Gestión del ciclo de vida del producto).

Los packages de software de IGE+XAO gestionan multiples tipos de diseños (incluidos los diagramas de sistemas y P&ID), así como los diseños detallados, como los diagramas de principio y los planos de cableado.

Los softwares de diseño eléctrico de IGE+XAO proporcionan potentes funciones dedicadas a la ingeniería eléctrica, incluyendo bibliotecas completas (símbolos y bases de datos de materiales) y herramientas dedicadas para la automatización de tareas eléctricas.

IGE+XAO ofrece una gama de paquetes de software para la gestión de proyectos eléctricos (Electrical PDM), así como visualizadores avanzados para el taller/montaje.

Con el fin de integrarse perfectamente con los sistemas de información de los clientes, IGE+XAO ofrece una gama completa de interfaces para: CAD mecánicos (Catia, SolidWorks, Creo, NX, Inventor, AutoCAD), PDM (SmarTeam, Windchill, TeamCenter, SolidWorks PDM), ERP (SAP), aplicaciones específicas (programación de PLC, etiquetado, mecanizado de paneles/armarios, fabricación de cables), así como programas de gestión de documentación, archivado y presupuestos.

IGE+XAO comercializa una gama completa de software de su filial Prosyst para gestionar: - Estudios de automatización y generación de documentación asociada. - Descripción y simulación de componentes eléctricos, mecánicos e hidráulicos para cualquier instalación eléctrica. - Diagnóstico, análisis y optimización de procesos automatizados.

La suite de software SEE Electrical Harness Manufacturing, con sus diferentes módulos, cubre todos los requisitos para la fabricación de mazos de cables eléctricos/harnesses.

En unos pocos clics, encuentre los productos que coinciden con su proyecto. No dude en ponerse en contacto con nosotros para obtener más información a través de la solicitud de información.

No dudes en contactarnos para obtener más información sobre nuestras soluciones.

Desde hace más de 35 años, el Grupo IGE+XAO concibe, desarrolla, comercializa y asegura el mantenimiento de una gama de productos de Concepción Asistida por Ordenador (CAD), de gestión de ciclo de vida "Product Lifecycle Management" (PLM) y de simulación dedicada a la electricidad. Nuestros softwares son desarrollados para ayudar en la industria a concebir y mantener la parte eléctrica de todo tipo de instalación. Este tipo de CAD/ PLM/ Simulación es denominado "CAD eléctrico/ PLM/ Simulación". Desde junio de 2014, con la compra de la empresa Prosyst, IGE+XAO propone una oferta completa para la simulacion de las instalaciones eléctricas.

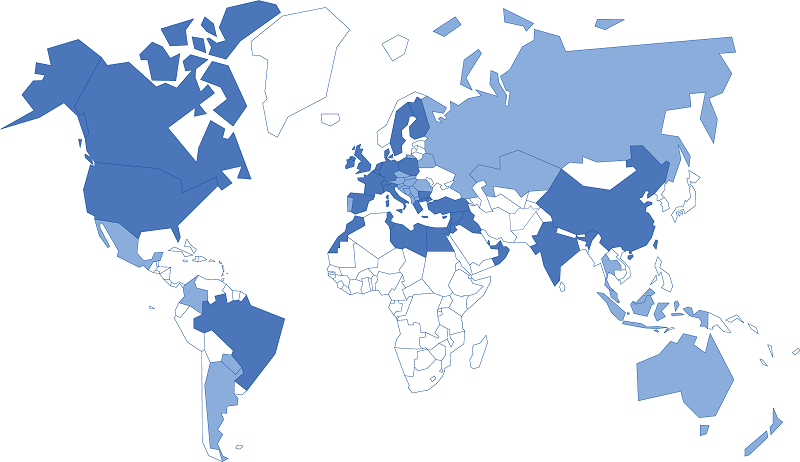

Presencia en los principales países europeos, así como en América del Norte, a través de agencias y subsidiarias que generaron casi el 50% de su facturación en el año finalizado el 31 de julio de 2016.

Contactos locales Hágase distribuidor