Das Ziel von IGE+XAO ist es, alle Branchen mit einer passenden und umfassenden Softwarelösung zu versorgen und ein komplettes Produktportfolio für jede Unternehmensgröße (KMU, SMB und Großunternehmen) anzubieten.

Das IGE + XAO-Softwarepaket verwaltet sowohl Gesamtentwürfe als auch detaillierte Entwürfe wie Prinzipdiagramme und Kabelpläne.

Das Softwarepaket Elektrisches Design von IGE + XAO bietet leistungsstarke Funktionen für die Elektrotechnik.

IGE + XAO bietet eine Reihe von Softwarepaketen für die Verwaltung elektrischer Projekte an.

Um sich nahtlos in das Kundeninformationssystem zu integrieren, bietet IGE + XAO eine breite Palette an Schnittstellen.

IGE + XAO vertreibt eine komplette Reihe von Software von seinem Tochterunternehmen Prosyst

SEE Electrical Harness Manufacturing deckt alle Anforderungen für die Herstellung von Kabelbäumen ab

Finden Sie schnell die Produkte, die Ihren Anforderungen entsprechen. Zögern Sie nicht, uns über den Anforderungslink für weitere Informationen zu kontaktieren.

Wir hoffen, Sie finden unsere Website hilfreich. Wenn Sie Fragen haben, zögern Sie bitte nicht, uns per Telefon, Nachrichtenformular oder E-Mail zu kontaktieren.

Wir antworten Ihnen so schnell wie möglich.

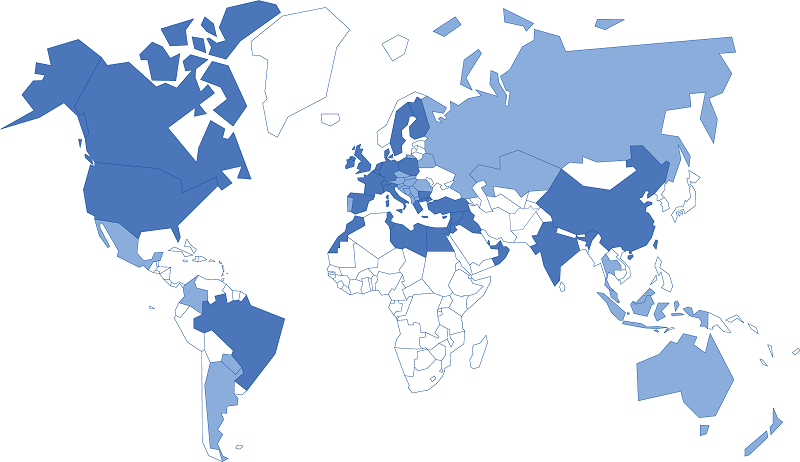

Seit über 35 Jahren betreibt die IGE+XAO Gruppe die Softwareentwicklung, die Herstellung, den Verkauf und die Pflege Ihrer Produkte im Bereich der Computer Aided Design Softwarelösungen (kurz 'CAD'), Product Lifecycle Management (kurz 'PLM') und spezielle Simulationssoftware für Elektroingenieure. Diese Art von CAD / PLM / Simulation wird als "CAD / PLM / Elektrische Simulation" bezeichnet. Mit der Akquisition von Prosyst bieten wir seit Mitte 2014 auch eine komplette Paketfamilie für die Funktionssimulation elektrischer Anlagen an. IGE + XAO beschäftigt weltweit 370 Mitarbeiter an 31 Standorten in 20 Ländern. Über 96500 Lizenzen unserer Softwarelösungen sind weltweit im Einsatz.

Mit mehr als 91 000 verkauften Lizenzen und über 42 500 Kunden ist IGE+XAO einer der weltweit führenden Anbieter von E-CAD-Lösungen. Zusätzlich wird IGE+XAO in weiteren 26 Ländern über Partner vertreten.

Lokale Kontakte Vertriebspartner werden